M Lhuillier’s Kwarta Padala has touched the lives of millions of Filipinos by connecting families, allowing unforgettable celebrations, creating beautiful memories, conveying comfort, extending helping hands, facilitating business transactions, and helping fulfill many Filipinos’ dreams. With this, ML Kwarta Padala is delivered whenever and wherever it is needed!Įasy procedures, convenient locations, and readily available cash in all of its branches make sending and receiving money effortless, which differentiates the ML Kwarta Padala brand from the others… setting as one of the best remittance players in the world.

Propelled by a strong drive to deliver service excellence and total customer satisfaction, M Lhuillier demonstrates its leadership in the money remittance service by expanding its network of branches in the Philippines and strengthening strong partner networks abroad and by using an extremely reliable technology-based system. Loanstar Technologies delivers new-age technology to connect lenders to borrowers, creating POS consumer loans with the help of their merchant network in numerous verticals.The ML Kwarta Padala is a leading remittance service provider here in the Philippines and also abroad and has served millions of Filipinos in sending and receiving their money to meet all their family’s financial needs. As a trusted provider of mission-critical financial services software, Finastra will help us connect with the right bank providers to bring billions of dollars of new liquidity to fund POS loans with our merchant customers.”Ĭonsumer Lending introduces APIs on Finastra’s FusionFabric.cloud open platform with Loanstar Technologies, like third party agency to integrate. Consumer Lending solution of Finastra allows financial institutions to access a marketplace of merchants and distributors to wide-spread their banking products.Īndrew Turner, CEO, Loanstar Technologies, stated, “Working with Finastra will enable us to scale up significantly, providing access to hundreds of financial institutions, like Seattle Bank, across the US. BaaS or banking-as-a-Serviceis a kind of offering that allows vendors find numerous lenders and their specific products. The solution builds connectivity and relationships between financial institutions and the distributor organizations that embed lending solutions at merchants’ point-of-sale.”Įmbedded Consumer Lending of Finastra eyes on making buying procedure as hassle-free as possible and providing an alternative to the Buy Now Pay Later (BNPL) approach and many times which don’t allow for expensive purchases. Jeannette Kescenovitz, Senior Director, Solution Management, Banking as a Service and Orchestration, Finastra, commented, “Finastra’s Embedded Consumer Lending solution offers financial institutions a direct route to growth by offering loans via a merchant’s digital point-of-sale. Vendors, financial institutions, and distributors can take benefit from a platform that offers lending solutions to consumers. Its solutions make consumers capable to deploy technology in the cloud or on-premises.įinastra unveils its embedded consumer lending solution, allowing access to conventionally regulated lending options for customers at point-of-sale (POS).

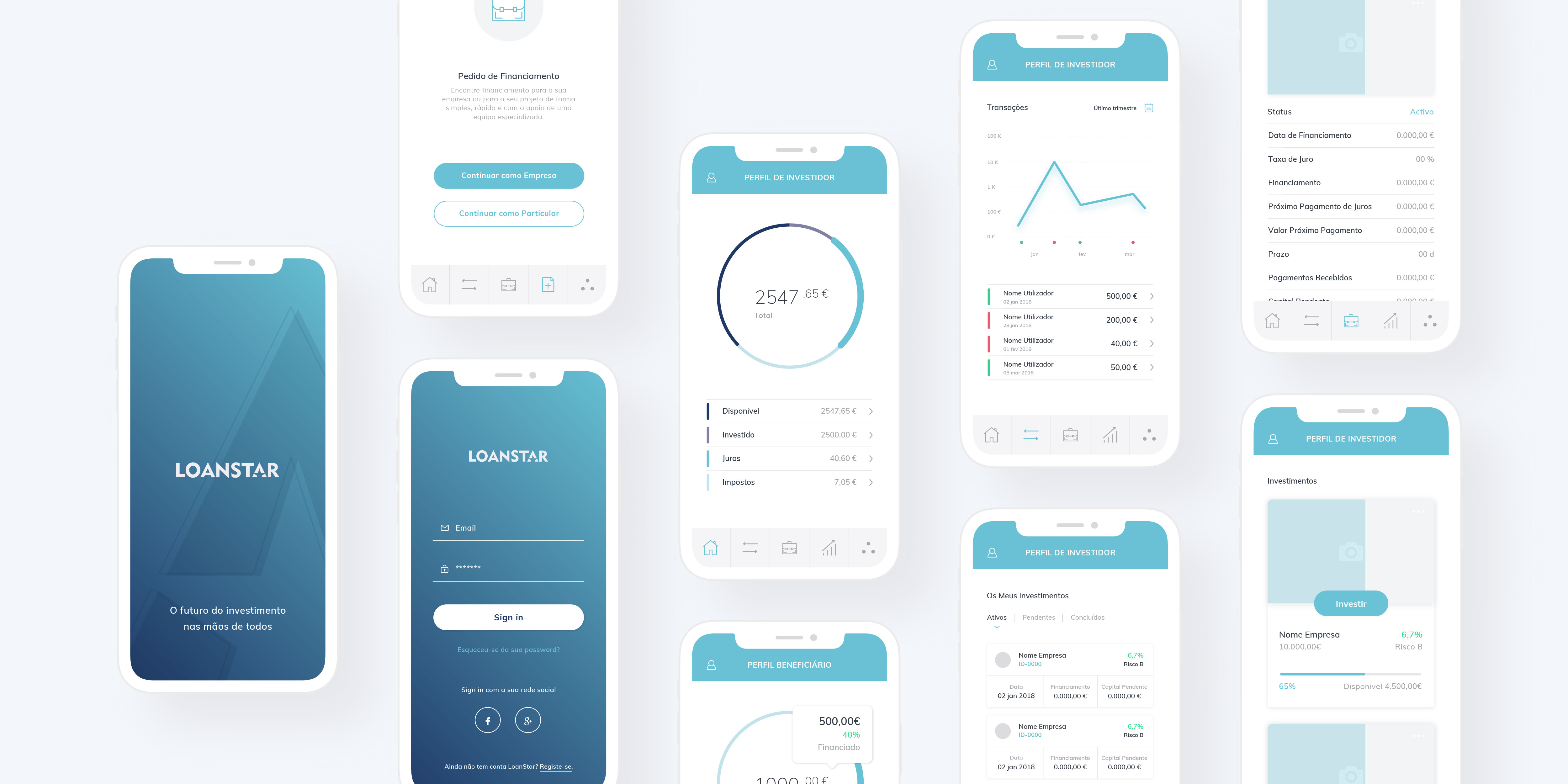

LOANSTAR TECHNOLOGIES SOFTWARE

Established in 2017, it has a strong compilation of financial services software in the world. Finastra a London-based financial service provider helps people and businesses that are engaged in finance, with an innovative platform.

0 kommentar(er)

0 kommentar(er)